Confidential - Do not share without permission

Back

Confidential - Do not share without permission

Back

Performance

-

-

AI-driven talent marketplace that matches domain experts (e.g., lawyers, doctors, engineers) with major AI labs (like OpenAI and Anthropic) to help train their models.

Memo Highlights

Confidential

Do not share

Deck only available via Desktop

Highlights

Mercor has emerged as one of the fastest-scaling AI infrastructure companies in history, achieving unprecedented growth and establishing itself as a critical player in the reinforcement learning economy. In just 17 months, company has scaled from $1M to $500M in ARR, the fastest revenue growth trajectory across all SaaS and marketplace companies on record. Their growth is escalating and at their current trajectory, they could reach $1B ARR by the end of 2025. They closed their $350M Series C at a $10B valuation (announced October 2025).

The company operates at the intersection of two massive trends: the explosion of demand for high-quality training data for AI model development, and a fundamental reimagining of how human expertise drives AI advancement. Mercor connects top-tier AI labs, including partnerships with 5 of the top AI labs and 6 of the Magnificent 7 tech companies, with vetted domain experts across specialized fields. By solving a critical bottleneck in AI model training, Mercor has achieved extraordinary financial metrics: zero customer churn, 1,600%+ net revenue retention, and daily payouts exceeding $1.5 million to its contractor base.

The modern AI economy faces a critical infrastructure gap: the traditional global labor market is fundamentally broken for high-skilled, specialized work. Three interconnected problems create this market failure:

1. Misallocation of Talent

The global labor market is the largest and least efficient major economy, leaving billions of dollars of economic value on the table through poor matching. Historically, talent acquisition relied on resume screening, interviews conducted by generalists, and geographical proximity. This system systematically fails to identify the world's best talent, particularly for niche expertise required to train advanced AI models. Talented professionals from emerging markets lack access to opportunities proportional to their capabilities, while AI labs struggle to find qualified domain experts.

2. The Evaluation Bottleneck

As generative AI models have advanced, the limiting factor in model improvement has shifted from compute to quality human feedback. Creating robust evaluation frameworks for AI systems requires domain-specific expertise that cannot be commoditized: lawyers must evaluate legal reasoning, doctors must assess medical decision-making, and bankers must validate financial analysis. Yet sourcing these experts globally, managing compliance across jurisdictions, and structuring payment systems has remained extraordinarily complex. Traditional data labeling platforms (paying $20-30/hour generalists) proved insufficient for complex evaluation tasks requiring professional judgment.

3. Global Payment and Compliance Chaos

Existing infrastructure for international contractor payments remains fragmented. Managing currency conversion, tax compliance across multiple jurisdictions, contractor classification, and legal status creates operational nightmares for companies seeking to build truly global talent networks. This friction has historically limited companies' ability to access talent beyond their headquarters' geography.

The impact: AI labs cannot efficiently train and refine frontier models at the speed the market demands, paying premium prices to overcome sourcing and operational friction.

Mercor reimagines global talent allocation through an AI-powered, compliance-managed marketplace specifically designed for the reinforcement learning economy.

The platform combines three core components:

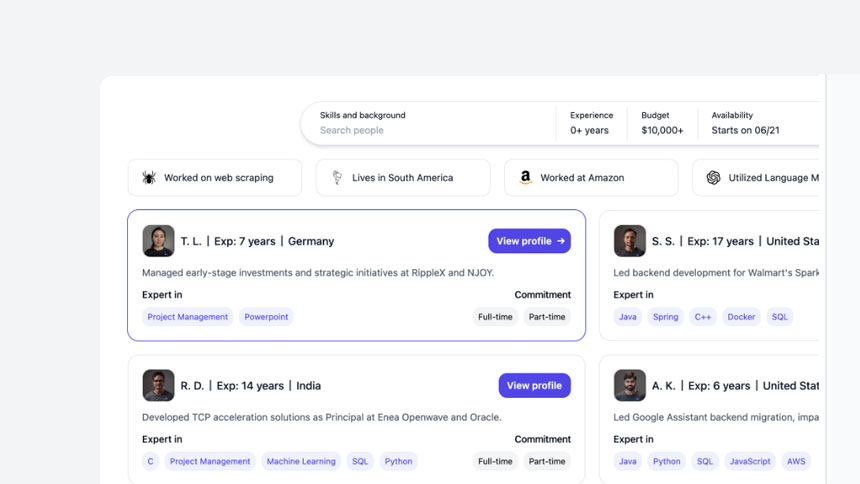

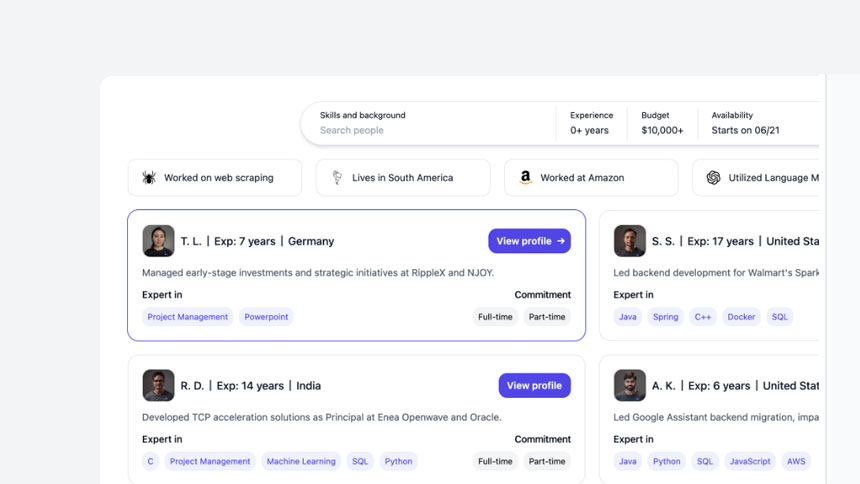

1. AI-Driven Talent Matching

Mercor's proprietary AI system moves beyond resume matching to deep candidate evaluation. The process begins with comprehensive profile analysis, progresses through dynamic AI interviews (generating role-specific questions and evaluating responses), and culminates in AI-powered matching against client needs. The system analyzes candidates' skills, experience, work history, and performance to predict job suitability with accuracy exceeding human decision-makers. Mercor has built a flywheel where every hire and performance review strengthens its prediction models, a defensible competitive advantage. linkventures

The platform has vetted over 500,000 interviews and grown its global talent pool to 1+ million experts as of 2025. Critically, the vetting process identifies "power-law experts", the top-tier domain specialists who drive disproportionate value. Mercor's data shows that approximately 10% of its experts drive the majority of model improvements, a finding the company has systematized into its matching algorithm. mercor

2. Specialization in High-Value Knowledge Work

Unlike traditional freelance platforms, Mercor focuses exclusively on specialized professionals: software engineers specializing in AI agents, machine learning researchers, legal experts, management consultants, investment bankers, medical professionals, and creative specialists. The average compensation for talent on the platform is $95/hour (with top-tier experts commanding up to $500/hour), a stark contrast to the $20-30/hour typical for data labeling platforms. This specialization creates a quality moat: the platform attracts extraordinary talent and matches them with companies capable of valuing their expertise. dataphoenix

3. End-to-End Managed Services

Mercor handles the entire operational complexity of international hiring: candidate sourcing and vetting, interview facilitation, compliance management across jurisdictions, contract administration, and compliant global payments. This removes friction that historically limited companies' ability to hire specialized talent globally. Weekly payouts ensure contractor satisfaction and retention. declom

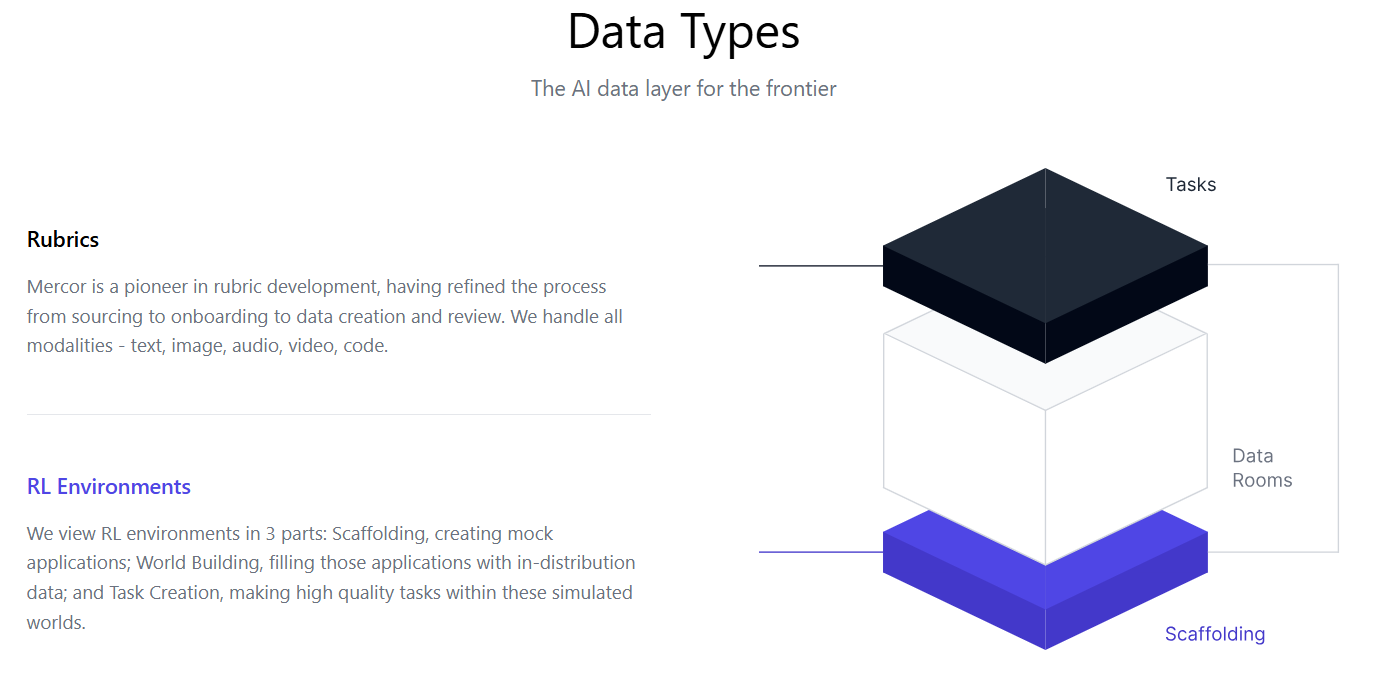

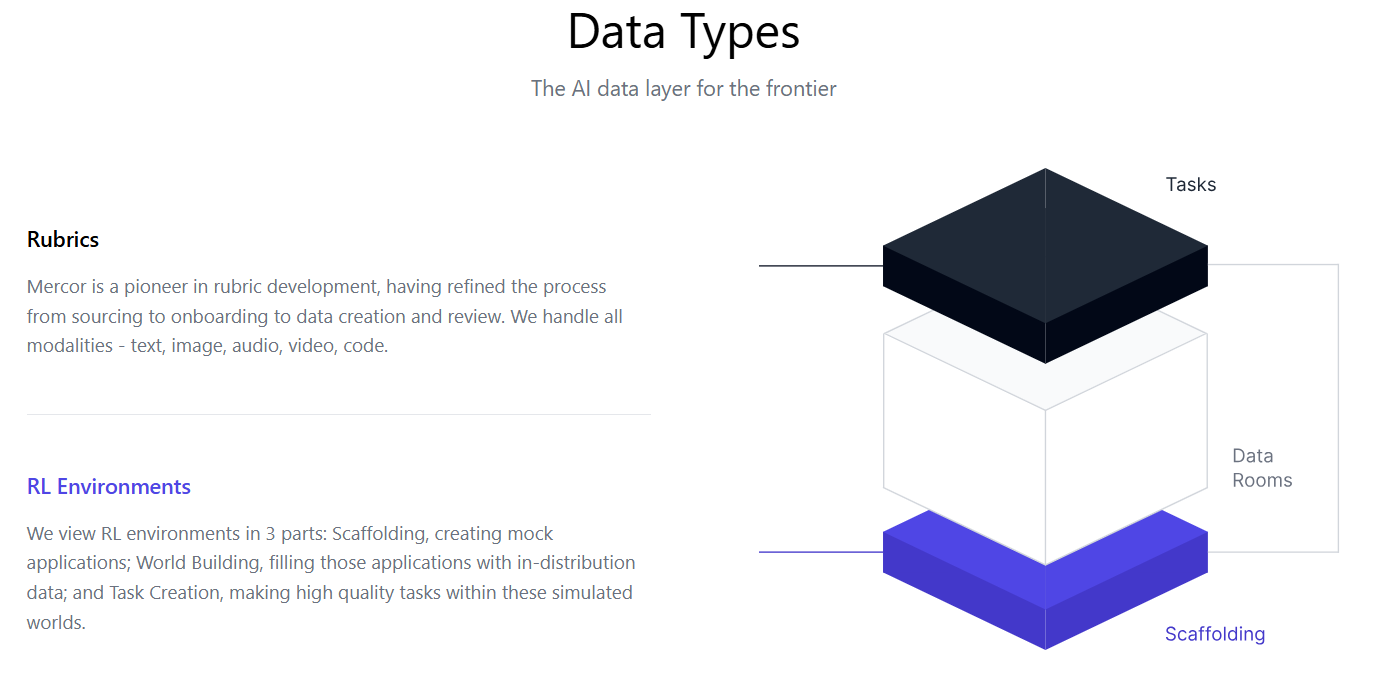

Mercor's product ecosystem comprises several interconnected offerings:

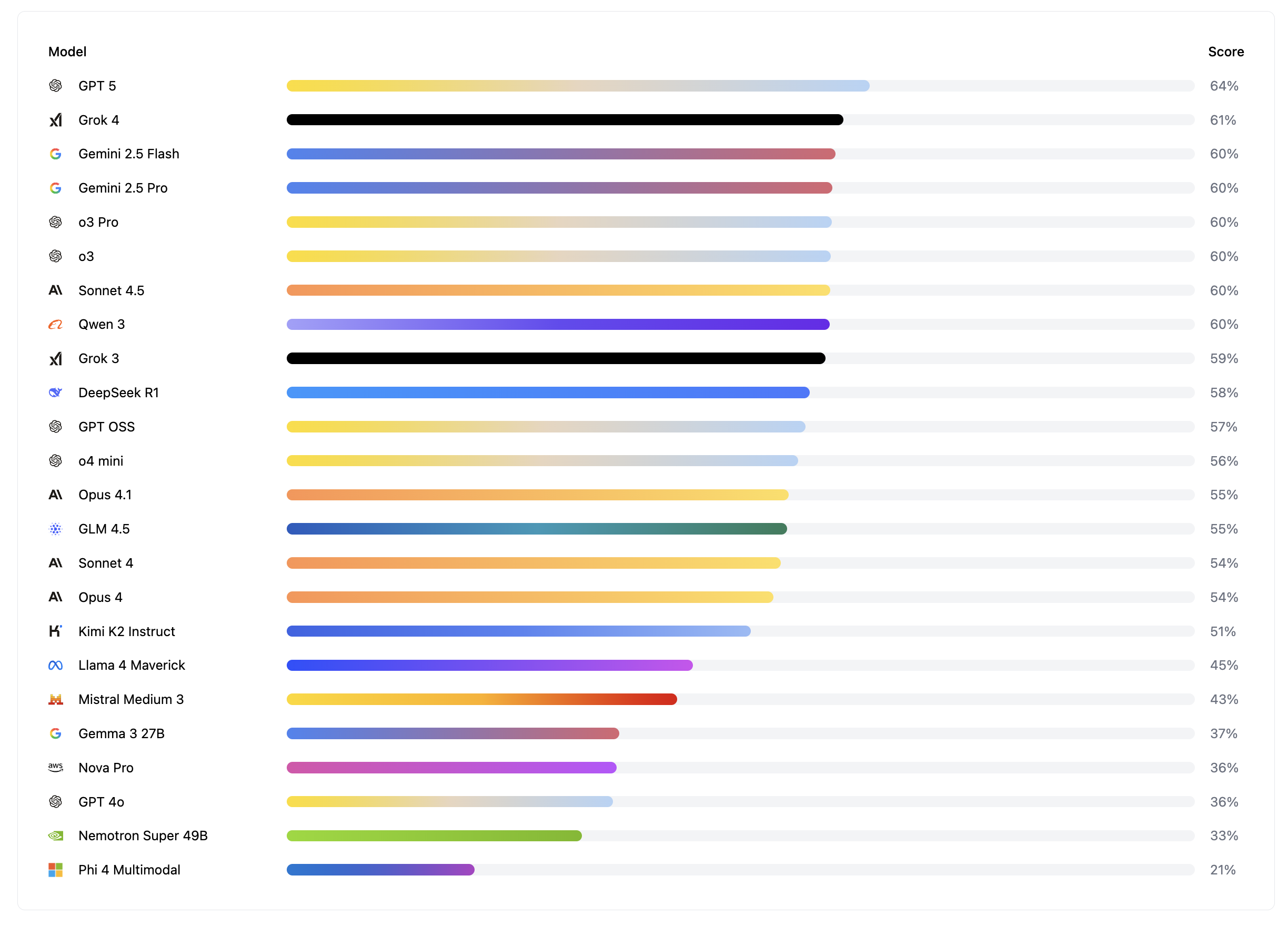

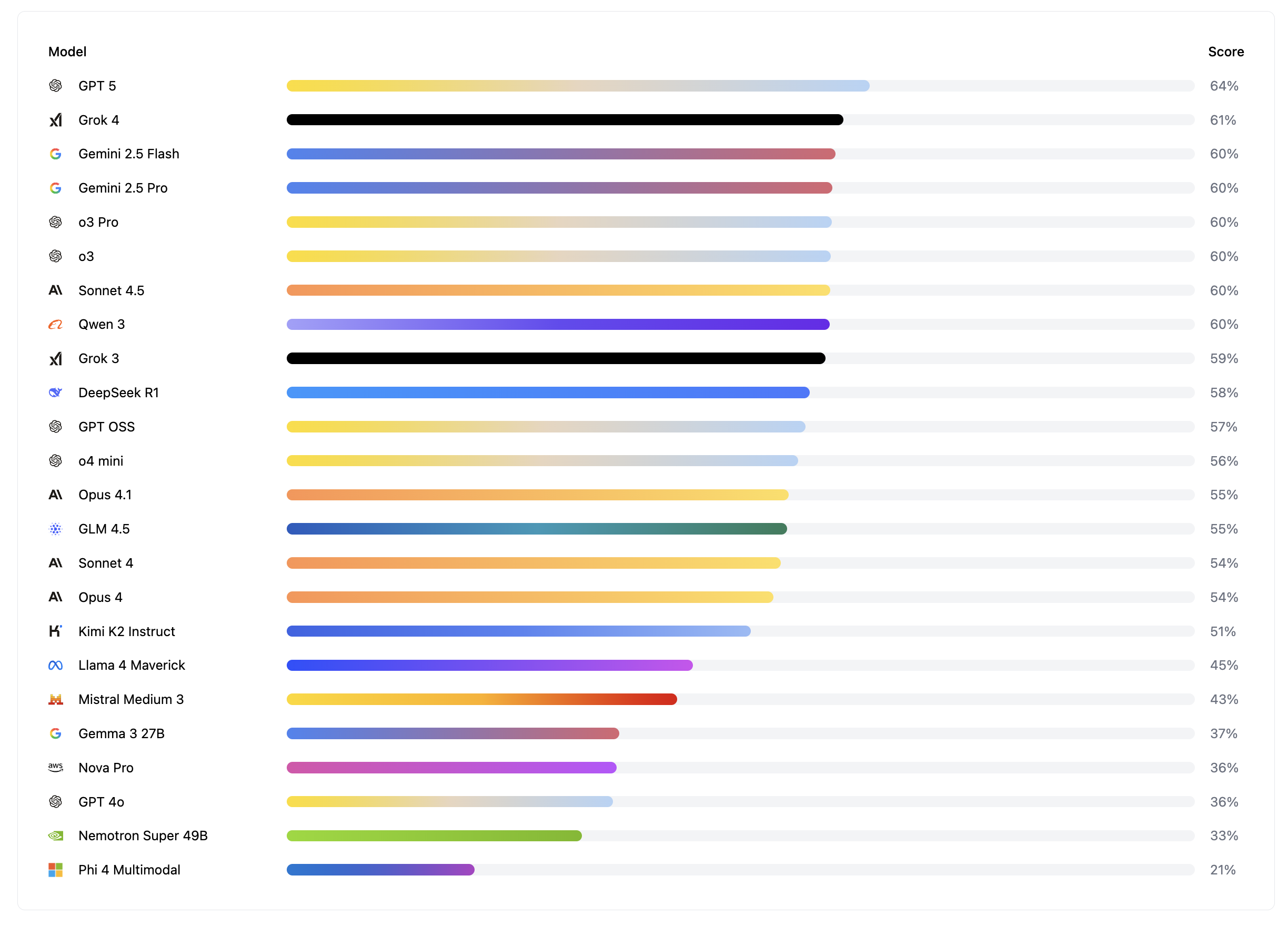

1. APEX: The AI Productivity Index (Recently Launched)

In September 2025, Mercor launched APEX, a first-of-its-kind benchmark evaluating AI models based on their ability to perform economically valuable knowledge work. Rather than measuring capabilities on abstract benchmarks, APEX assesses AI performance on real-world professional tasks: investment banking deal analysis, legal document review, strategy consulting, and medical diagnosis. mercor

APEX v1.0 includes 200 professionally-designed cases with an average of 5.83 source documents (26,000 tokens) per prompt and 29 evaluation criteria per case. Tasks were designed by leading domain experts including former Treasury Secretary Larry Summers, former McKinsey Managing Partner Dominic Barton, legal scholar Cass Sunstein, and cardiologist Dr. Eric Topol. The benchmark requires advanced reasoning and critical thinking, experts estimated tasks would require 1-8 hours of professional time (average 3.5 hours) for a human to complete. mercor

APEX represents a major product expansion: by creating the evaluation standard for economically valuable AI work, Mercor strengthens its position with frontier labs and establishes a new distribution channel for its evaluator network.

2. Core Talent Marketplace

The platform connects AI labs and technology companies with vetted professionals for:

3. Managed Research Services

Mercor has established a dedicated research division specializing in advanced evaluation design and frontier data systems. The company works directly with leading labs to refine rubrics, design reinforcement learning environments, and pioneer new data formats for model improvement. mercor

The total addressable market for Mercor spans multiple overlapping markets, all experiencing explosive growth driven by AI advancement:

1. Global Recruitment Market

The global recruitment market reached approximately $642 billion in 2025 and is expected to grow at a 7.56% CAGR to reach $924 billion by 2030. Some research firms project even more aggressive growth, with the market reaching $856 billion in 2025 and expanding to $2.93 trillion by 2035 (13.1% CAGR). Recruitment process outsourcing (RPO), the segment most analogous to Mercor's model, is forecast to grow at 9.34% CAGR through 2030, outpacing traditional staffing. mordorintelligence

However, these aggregate figures undersell the opportunity in specialized talent markets. Mercor targets elite technical and knowledge work, a much smaller but higher-margin segment than general recruitment.

2. AI Training Data and Evaluation

The specialized segment where Mercor has established dominance shows explosive growth. The AI training dataset market was valued at $2.86-6.02 billion in 2024-2025 and is projected to reach $13.29-52.41 billion by 2034-2035, depending on the research firm, with CAGRs ranging from 16.55% to 24.16%. precedenceresearch

This market growth is directly correlated with the escalation of frontier AI model development. Each generation of more capable models requires exponentially more evaluation and training signal. Unlike previous AI eras, current frontier models require professional judgment to improve, not commodity labor. Mercor captures this segment by being the primary source of that professional judgment.

3. Talent Allocation in the Reinforcement Learning Economy

Mercor is building the foundational infrastructure for an emerging economic category: the "reinforcement learning economy," where professional experts continuously train and refine AI systems. As AI systems become more capable, the opportunity to create economic value by optimizing human-in-the-loop systems expands dramatically. Mercor is positioning itself as the infrastructure layer for this economy, similar to how infrastructure companies like AWS or Stripe became essential layers in their respective technology paradigms.

Market Drivers Specific to Mercor's Opportunity:

Mercor's financial and operational metrics demonstrate extraordinary momentum:

Revenue Growth

Customer Quality and Retention

Contractor Base

Funding and Valuation Trajectory

Product Innovation

Mercor operates in a fragmented competitive landscape characterized by companies operating at different points along the talent-to-AI-infrastructure spectrum:

Direct Competitors - Talent Marketplace Models:

Related Competitors - Data Labeling and Evaluation:

Emerging Competitors:

Competitive Advantages:

Mercor's defensibility derives from multiple reinforcing factors:

Competitive Position:

Mercor holds the strongest market position among specialized talent marketplace competitors. While Scale AI historically held the market leadership in data labeling, Meta's acquisition created customer uncertainty. Mercor captured this moment: the company reportedly quadrupled in size following Scale's acquisition, indicating rapid customer switching and market consolidation in its favor.

Mercor's founding team exemplifies the combination of founder-level execution and elite intellectual horsepower required to execute at hypergrowth:

Brendan Foody - Co-founder and CEO

Foody is the strategic architect driving the company's vision and execution. He was studying Economics and Business Administration at Georgetown University (2021-2023) when he co-founded Mercor. In spring 2023, during his sophomore year, rather than attend finals, he committed fully to the startup, a decision that proved prescient. Foody is the public face of the company, articulating its strategic vision and building relationships with frontier labs. He has received recognition including the Thiel Fellowship, and his strategic insights have influenced how the startup community thinks about labor markets and AI infrastructure. globalindiantimes

Adarsh Hiremath - Co-founder and Chief Technology Officer

Hiremath brings elite technical credibility to the team. He studied Computer Science and Machine Learning at Harvard University, where he conducted ML research and worked as a research assistant to former U.S. Treasury Secretary Larry Summers. During his sophomore year at Harvard, he co-founded Mercor with Foody and Midha, subsequently dropping out to pursue the company full-time. Hiremath's background in machine learning and AI research directly informs the company's core technology stack, including its AI interview systems and matching algorithms. globalindiantimes

Surya Midha - Co-founder and Chief Operations Officer

Midha holds responsibility for operational execution and scaling. Born in Mountain View and raised in San Jose, California, he studied Foreign Service at Georgetown but dropped out to co-found Mercor. As COO, Midha drives the operational excellence that enables the company's hypergrowth—managing scaling of infrastructure, contractor payments, compliance, and other operational dimensions critical to the marketplace model. His governance and operational focus complements Foody's strategic vision and Hiremath's technical execution. globalindiantimes

Global Context

The market for specialized talent acquisition and AI training infrastructure exists at the intersection of multiple explosive trends in the global economy:

1. Globalization of Knowledge Work

Remote work adoption has fundamentally transformed where knowledge work can be performed. The COVID-19 pandemic accelerated normalization of distributed teams; as of 2025, remote work remains standard practice across technology and professional services companies. This creates a genuine global labor market where talented professionals worldwide can access opportunities previously limited by geography. However, the infrastructure to efficiently source, vet, and pay such talent globally remains nascent. Mercor is building this infrastructure.

2. AI Model Training Becomes the Economic Bottleneck

In previous technology eras, the constraint was typically compute (GPUs, data centers). In the current frontier AI environment, with access to compute increasingly commoditized among well-funded labs, the constraint has shifted to evaluation and training signal. Creating robust evaluation frameworks requires deep domain expertise: what constitutes high-quality legal reasoning? What are the hallmarks of successful consulting analysis? How should medical diagnostic reasoning be validated? These questions cannot be answered by low-cost commodity labor—they require the experts themselves.

Mercor captures this shift by being the primary source of such expertise. The company's founding narrative—that "the real opportunity is teaching [models] what only humans know: judgment, nuance, and taste"—directly addresses this economic inflection point. fortune

3. Explosion of Frontier AI Lab Competition

As AI development has transitioned from research to competitive product development, capital has concentrated among a small number of frontier labs (OpenAI, Google DeepMind, Anthropic, Meta, xAI, etc.). Each of these organizations is training progressively larger and more capable models, each requiring exponentially more evaluation and training signal. A single frontier-scale model training run may require hundreds of thousands of professional evaluations—creating an enormous pull on Mercor's supply.

4. Meta's Scale AI Investment as Market Inflection

Meta's $14-14.8 billion investment in Scale AI (acquiring 49% stake) in June 2025 created a critical market moment. For companies that had relied on Scale AI, including reportedly OpenAI and Google DeepMind. the acquisition raised immediate concerns about conflicts of interest and data privacy. These customer concerns accelerated Mercor's customer acquisition, with the company reportedly quadrupling in size following this market disruption. reddit

This was not coincidental: Mercor had positioned itself as a Scale alternative before Meta's acquisition closed. The company's rapid growth following the acquisition (from $50M ARR in November 2024 to $500M ARR by September 2025) directly correlates with Scale customers seeking alternatives. canvasbusinessmodel

Market Size and Growth

Specialized Talent Marketplace Segment:

While the overall recruitment market is substantial ($642B-$856B globally in 2025), Mercor operates in a specialized high-value segment: elite technical talent for AI and professional services. This segment is dramatically smaller but growing exponentially as AI adoption accelerates.

AI Training Data Market:

The AI training data market more directly represents Mercor's addressable market:

These growth rates are extraordinary compared to traditional talent acquisition markets (7-9% CAGR), reflecting the exponential growth in AI model development and the corresponding demand for training data and evaluation.

Mercor's Market Share Opportunity:

If Mercor has achieved $500 million ARR with 5-6 major lab customers, the company has captured an outsized share of a market previously dominated by Scale AI. The $13-52 billion projected market size represents a 26x-104x expansion opportunity from current levels. Even assuming significant growth in competitor market share and market fragmentation, substantial room remains for continued expansion.

Four converging factors have created an extraordinary moment for Mercor's business:

1. The Evaluation Era Has Arrived

For the first 15 years of the modern AI era (2008-2023), model training focused on scaling compute and data. The paradigm was "more data, more compute = better models." Frontier models achieved remarkable capabilities on standard benchmarks and tasks.

However, as models have approached or exceeded human capability on many narrow tasks, the focus has shifted to evaluation and refinement. Creating models that perform reliably on real-world professional tasks requires expert evaluation frameworks (rubrics), training signal from domain specialists, and continuous refinement. This shift from "scale everything" to "evaluate and refine with experts" directly favors Mercor's model.

CEO Brendan Foody articulated this: "We've entered the era of evals. If the model is the product, evals are the PRD. AI Labs can't improve models without expert rubrics + verifiers. That's the bottleneck." linkedin

2. Frontier Lab Competition Intensified Demand

As AI development has transitioned from research (conducted at academia and national labs) to competitive product development by large technology companies, the demand for high-quality training signal has exploded exponentially. Each generation of frontier models requires more evaluation and training data than the previous generation. Simultaneously, competition among frontier labs means they are willing to pay premium prices to acquire evaluation capacity.

3. Scale AI Acquisition Disrupted the Incumbent Market

Meta's June 2025 acquisition of Scale AI, while validating the market opportunity, created immediate customer concern. The acquisition raised valid questions: If Meta owns Scale AI, can competing labs trust Scale with their confidential training data and model evaluation? Would Meta use its access to evaluation data for competitive advantage?

This customer uncertainty was not abstract: reports indicate OpenAI and Google DeepMind shifted from Scale to alternative providers following the acquisition. Mercor, having positioned itself as a direct Scale alternative with superior contractor quality ($95/hour vs. $30/hour) and established relationships with frontier labs, captured this wave of customer switching. reddit

Mercor represents a rare convergence of a massive market opportunity, a sustainable competitive advantage, and a capable founding team executing with urgency at an optimal market inflection point.

Market Opportunity: The global AI training data and professional evaluation market is growing at 16-24% CAGR, with total addressable market expanding from $3-6 billion today to $13-52 billion by 2034-2035. Mercor has captured an outsized initial market share, but substantial room remains for continued expansion.

Competitive Position: Zero customer churn, 1,600%+ net revenue retention, and partnerships with 5-6 of the world's leading AI labs establish Mercor as the market leader in elite professional evaluation services. Multiple reinforcing advantages (proprietary talent data, APEX benchmark, quality premium) create a defensible moat.

Execution: Scaling from $1M to $500M ARR in 17 months represents the fastest revenue growth trajectory in SaaS history. This execution, achieved with minimal sales and marketing infrastructure, demonstrates extraordinary customer demand and product-market fit.

Timing: Meta's Scale AI acquisition created a market inflection point that Mercor captured rapidly. The shift from commodity data labeling to professional evaluation aligns with Mercor's core strengths. The exponential scaling of frontier AI labs' evaluation needs creates years of runway for continued hypergrowth.

Team: Three 22-year-old founders, backed by elite venture investors and angels (Thiel, Summers, Dorsey), demonstrate founder-level execution capabilities. The team's debate background, structured reasoning and rhetoric, maps directly onto the company's mission of teaching AI systems judgment and nuance.

Memo

Mercor has emerged as one of the fastest-scaling AI infrastructure companies in history, achieving unprecedented growth and establishing itself as a critical player in the reinforcement learning economy. In just 17 months, company has scaled from $1M to $500M in ARR, the fastest revenue growth trajectory across all SaaS and marketplace companies on record. Their growth is escalating and at their current trajectory, they could reach $1B ARR by the end of 2025. They closed their $350M Series C at a $10B valuation (announced October 2025).

The company operates at the intersection of two massive trends: the explosion of demand for high-quality training data for AI model development, and a fundamental reimagining of how human expertise drives AI advancement. Mercor connects top-tier AI labs, including partnerships with 5 of the top AI labs and 6 of the Magnificent 7 tech companies, with vetted domain experts across specialized fields. By solving a critical bottleneck in AI model training, Mercor has achieved extraordinary financial metrics: zero customer churn, 1,600%+ net revenue retention, and daily payouts exceeding $1.5 million to its contractor base.

The modern AI economy faces a critical infrastructure gap: the traditional global labor market is fundamentally broken for high-skilled, specialized work. Three interconnected problems create this market failure:

1. Misallocation of Talent

The global labor market is the largest and least efficient major economy, leaving billions of dollars of economic value on the table through poor matching. Historically, talent acquisition relied on resume screening, interviews conducted by generalists, and geographical proximity. This system systematically fails to identify the world's best talent, particularly for niche expertise required to train advanced AI models. Talented professionals from emerging markets lack access to opportunities proportional to their capabilities, while AI labs struggle to find qualified domain experts.

2. The Evaluation Bottleneck

As generative AI models have advanced, the limiting factor in model improvement has shifted from compute to quality human feedback. Creating robust evaluation frameworks for AI systems requires domain-specific expertise that cannot be commoditized: lawyers must evaluate legal reasoning, doctors must assess medical decision-making, and bankers must validate financial analysis. Yet sourcing these experts globally, managing compliance across jurisdictions, and structuring payment systems has remained extraordinarily complex. Traditional data labeling platforms (paying $20-30/hour generalists) proved insufficient for complex evaluation tasks requiring professional judgment.

3. Global Payment and Compliance Chaos

Existing infrastructure for international contractor payments remains fragmented. Managing currency conversion, tax compliance across multiple jurisdictions, contractor classification, and legal status creates operational nightmares for companies seeking to build truly global talent networks. This friction has historically limited companies' ability to access talent beyond their headquarters' geography.

The impact: AI labs cannot efficiently train and refine frontier models at the speed the market demands, paying premium prices to overcome sourcing and operational friction.

Mercor reimagines global talent allocation through an AI-powered, compliance-managed marketplace specifically designed for the reinforcement learning economy.

The platform combines three core components:

1. AI-Driven Talent Matching

Mercor's proprietary AI system moves beyond resume matching to deep candidate evaluation. The process begins with comprehensive profile analysis, progresses through dynamic AI interviews (generating role-specific questions and evaluating responses), and culminates in AI-powered matching against client needs. The system analyzes candidates' skills, experience, work history, and performance to predict job suitability with accuracy exceeding human decision-makers. Mercor has built a flywheel where every hire and performance review strengthens its prediction models, a defensible competitive advantage. linkventures

The platform has vetted over 500,000 interviews and grown its global talent pool to 1+ million experts as of 2025. Critically, the vetting process identifies "power-law experts", the top-tier domain specialists who drive disproportionate value. Mercor's data shows that approximately 10% of its experts drive the majority of model improvements, a finding the company has systematized into its matching algorithm. mercor

2. Specialization in High-Value Knowledge Work

Unlike traditional freelance platforms, Mercor focuses exclusively on specialized professionals: software engineers specializing in AI agents, machine learning researchers, legal experts, management consultants, investment bankers, medical professionals, and creative specialists. The average compensation for talent on the platform is $95/hour (with top-tier experts commanding up to $500/hour), a stark contrast to the $20-30/hour typical for data labeling platforms. This specialization creates a quality moat: the platform attracts extraordinary talent and matches them with companies capable of valuing their expertise. dataphoenix

3. End-to-End Managed Services

Mercor handles the entire operational complexity of international hiring: candidate sourcing and vetting, interview facilitation, compliance management across jurisdictions, contract administration, and compliant global payments. This removes friction that historically limited companies' ability to hire specialized talent globally. Weekly payouts ensure contractor satisfaction and retention. declom

Mercor's product ecosystem comprises several interconnected offerings:

1. APEX: The AI Productivity Index (Recently Launched)

In September 2025, Mercor launched APEX, a first-of-its-kind benchmark evaluating AI models based on their ability to perform economically valuable knowledge work. Rather than measuring capabilities on abstract benchmarks, APEX assesses AI performance on real-world professional tasks: investment banking deal analysis, legal document review, strategy consulting, and medical diagnosis. mercor

APEX v1.0 includes 200 professionally-designed cases with an average of 5.83 source documents (26,000 tokens) per prompt and 29 evaluation criteria per case. Tasks were designed by leading domain experts including former Treasury Secretary Larry Summers, former McKinsey Managing Partner Dominic Barton, legal scholar Cass Sunstein, and cardiologist Dr. Eric Topol. The benchmark requires advanced reasoning and critical thinking, experts estimated tasks would require 1-8 hours of professional time (average 3.5 hours) for a human to complete. mercor

APEX represents a major product expansion: by creating the evaluation standard for economically valuable AI work, Mercor strengthens its position with frontier labs and establishes a new distribution channel for its evaluator network.

2. Core Talent Marketplace

The platform connects AI labs and technology companies with vetted professionals for:

3. Managed Research Services

Mercor has established a dedicated research division specializing in advanced evaluation design and frontier data systems. The company works directly with leading labs to refine rubrics, design reinforcement learning environments, and pioneer new data formats for model improvement. mercor

The total addressable market for Mercor spans multiple overlapping markets, all experiencing explosive growth driven by AI advancement:

1. Global Recruitment Market

The global recruitment market reached approximately $642 billion in 2025 and is expected to grow at a 7.56% CAGR to reach $924 billion by 2030. Some research firms project even more aggressive growth, with the market reaching $856 billion in 2025 and expanding to $2.93 trillion by 2035 (13.1% CAGR). Recruitment process outsourcing (RPO), the segment most analogous to Mercor's model, is forecast to grow at 9.34% CAGR through 2030, outpacing traditional staffing. mordorintelligence

However, these aggregate figures undersell the opportunity in specialized talent markets. Mercor targets elite technical and knowledge work, a much smaller but higher-margin segment than general recruitment.

2. AI Training Data and Evaluation

The specialized segment where Mercor has established dominance shows explosive growth. The AI training dataset market was valued at $2.86-6.02 billion in 2024-2025 and is projected to reach $13.29-52.41 billion by 2034-2035, depending on the research firm, with CAGRs ranging from 16.55% to 24.16%. precedenceresearch

This market growth is directly correlated with the escalation of frontier AI model development. Each generation of more capable models requires exponentially more evaluation and training signal. Unlike previous AI eras, current frontier models require professional judgment to improve, not commodity labor. Mercor captures this segment by being the primary source of that professional judgment.

3. Talent Allocation in the Reinforcement Learning Economy

Mercor is building the foundational infrastructure for an emerging economic category: the "reinforcement learning economy," where professional experts continuously train and refine AI systems. As AI systems become more capable, the opportunity to create economic value by optimizing human-in-the-loop systems expands dramatically. Mercor is positioning itself as the infrastructure layer for this economy, similar to how infrastructure companies like AWS or Stripe became essential layers in their respective technology paradigms.

Market Drivers Specific to Mercor's Opportunity:

Mercor's financial and operational metrics demonstrate extraordinary momentum:

Revenue Growth

Customer Quality and Retention

Contractor Base

Funding and Valuation Trajectory

Product Innovation

Mercor operates in a fragmented competitive landscape characterized by companies operating at different points along the talent-to-AI-infrastructure spectrum:

Direct Competitors - Talent Marketplace Models:

Related Competitors - Data Labeling and Evaluation:

Emerging Competitors:

Competitive Advantages:

Mercor's defensibility derives from multiple reinforcing factors:

Competitive Position:

Mercor holds the strongest market position among specialized talent marketplace competitors. While Scale AI historically held the market leadership in data labeling, Meta's acquisition created customer uncertainty. Mercor captured this moment: the company reportedly quadrupled in size following Scale's acquisition, indicating rapid customer switching and market consolidation in its favor.

Mercor's founding team exemplifies the combination of founder-level execution and elite intellectual horsepower required to execute at hypergrowth:

Brendan Foody - Co-founder and CEO

Foody is the strategic architect driving the company's vision and execution. He was studying Economics and Business Administration at Georgetown University (2021-2023) when he co-founded Mercor. In spring 2023, during his sophomore year, rather than attend finals, he committed fully to the startup, a decision that proved prescient. Foody is the public face of the company, articulating its strategic vision and building relationships with frontier labs. He has received recognition including the Thiel Fellowship, and his strategic insights have influenced how the startup community thinks about labor markets and AI infrastructure. globalindiantimes

Adarsh Hiremath - Co-founder and Chief Technology Officer

Hiremath brings elite technical credibility to the team. He studied Computer Science and Machine Learning at Harvard University, where he conducted ML research and worked as a research assistant to former U.S. Treasury Secretary Larry Summers. During his sophomore year at Harvard, he co-founded Mercor with Foody and Midha, subsequently dropping out to pursue the company full-time. Hiremath's background in machine learning and AI research directly informs the company's core technology stack, including its AI interview systems and matching algorithms. globalindiantimes

Surya Midha - Co-founder and Chief Operations Officer

Midha holds responsibility for operational execution and scaling. Born in Mountain View and raised in San Jose, California, he studied Foreign Service at Georgetown but dropped out to co-found Mercor. As COO, Midha drives the operational excellence that enables the company's hypergrowth—managing scaling of infrastructure, contractor payments, compliance, and other operational dimensions critical to the marketplace model. His governance and operational focus complements Foody's strategic vision and Hiremath's technical execution. globalindiantimes

Global Context

The market for specialized talent acquisition and AI training infrastructure exists at the intersection of multiple explosive trends in the global economy:

1. Globalization of Knowledge Work

Remote work adoption has fundamentally transformed where knowledge work can be performed. The COVID-19 pandemic accelerated normalization of distributed teams; as of 2025, remote work remains standard practice across technology and professional services companies. This creates a genuine global labor market where talented professionals worldwide can access opportunities previously limited by geography. However, the infrastructure to efficiently source, vet, and pay such talent globally remains nascent. Mercor is building this infrastructure.

2. AI Model Training Becomes the Economic Bottleneck

In previous technology eras, the constraint was typically compute (GPUs, data centers). In the current frontier AI environment, with access to compute increasingly commoditized among well-funded labs, the constraint has shifted to evaluation and training signal. Creating robust evaluation frameworks requires deep domain expertise: what constitutes high-quality legal reasoning? What are the hallmarks of successful consulting analysis? How should medical diagnostic reasoning be validated? These questions cannot be answered by low-cost commodity labor—they require the experts themselves.

Mercor captures this shift by being the primary source of such expertise. The company's founding narrative—that "the real opportunity is teaching [models] what only humans know: judgment, nuance, and taste"—directly addresses this economic inflection point. fortune

3. Explosion of Frontier AI Lab Competition

As AI development has transitioned from research to competitive product development, capital has concentrated among a small number of frontier labs (OpenAI, Google DeepMind, Anthropic, Meta, xAI, etc.). Each of these organizations is training progressively larger and more capable models, each requiring exponentially more evaluation and training signal. A single frontier-scale model training run may require hundreds of thousands of professional evaluations—creating an enormous pull on Mercor's supply.

4. Meta's Scale AI Investment as Market Inflection

Meta's $14-14.8 billion investment in Scale AI (acquiring 49% stake) in June 2025 created a critical market moment. For companies that had relied on Scale AI, including reportedly OpenAI and Google DeepMind. the acquisition raised immediate concerns about conflicts of interest and data privacy. These customer concerns accelerated Mercor's customer acquisition, with the company reportedly quadrupling in size following this market disruption. reddit

This was not coincidental: Mercor had positioned itself as a Scale alternative before Meta's acquisition closed. The company's rapid growth following the acquisition (from $50M ARR in November 2024 to $500M ARR by September 2025) directly correlates with Scale customers seeking alternatives. canvasbusinessmodel

Market Size and Growth

Specialized Talent Marketplace Segment:

While the overall recruitment market is substantial ($642B-$856B globally in 2025), Mercor operates in a specialized high-value segment: elite technical talent for AI and professional services. This segment is dramatically smaller but growing exponentially as AI adoption accelerates.

AI Training Data Market:

The AI training data market more directly represents Mercor's addressable market:

These growth rates are extraordinary compared to traditional talent acquisition markets (7-9% CAGR), reflecting the exponential growth in AI model development and the corresponding demand for training data and evaluation.

Mercor's Market Share Opportunity:

If Mercor has achieved $500 million ARR with 5-6 major lab customers, the company has captured an outsized share of a market previously dominated by Scale AI. The $13-52 billion projected market size represents a 26x-104x expansion opportunity from current levels. Even assuming significant growth in competitor market share and market fragmentation, substantial room remains for continued expansion.

Four converging factors have created an extraordinary moment for Mercor's business:

1. The Evaluation Era Has Arrived

For the first 15 years of the modern AI era (2008-2023), model training focused on scaling compute and data. The paradigm was "more data, more compute = better models." Frontier models achieved remarkable capabilities on standard benchmarks and tasks.

However, as models have approached or exceeded human capability on many narrow tasks, the focus has shifted to evaluation and refinement. Creating models that perform reliably on real-world professional tasks requires expert evaluation frameworks (rubrics), training signal from domain specialists, and continuous refinement. This shift from "scale everything" to "evaluate and refine with experts" directly favors Mercor's model.

CEO Brendan Foody articulated this: "We've entered the era of evals. If the model is the product, evals are the PRD. AI Labs can't improve models without expert rubrics + verifiers. That's the bottleneck." linkedin

2. Frontier Lab Competition Intensified Demand

As AI development has transitioned from research (conducted at academia and national labs) to competitive product development by large technology companies, the demand for high-quality training signal has exploded exponentially. Each generation of frontier models requires more evaluation and training data than the previous generation. Simultaneously, competition among frontier labs means they are willing to pay premium prices to acquire evaluation capacity.

3. Scale AI Acquisition Disrupted the Incumbent Market

Meta's June 2025 acquisition of Scale AI, while validating the market opportunity, created immediate customer concern. The acquisition raised valid questions: If Meta owns Scale AI, can competing labs trust Scale with their confidential training data and model evaluation? Would Meta use its access to evaluation data for competitive advantage?

This customer uncertainty was not abstract: reports indicate OpenAI and Google DeepMind shifted from Scale to alternative providers following the acquisition. Mercor, having positioned itself as a direct Scale alternative with superior contractor quality ($95/hour vs. $30/hour) and established relationships with frontier labs, captured this wave of customer switching. reddit

Mercor represents a rare convergence of a massive market opportunity, a sustainable competitive advantage, and a capable founding team executing with urgency at an optimal market inflection point.

Market Opportunity: The global AI training data and professional evaluation market is growing at 16-24% CAGR, with total addressable market expanding from $3-6 billion today to $13-52 billion by 2034-2035. Mercor has captured an outsized initial market share, but substantial room remains for continued expansion.

Competitive Position: Zero customer churn, 1,600%+ net revenue retention, and partnerships with 5-6 of the world's leading AI labs establish Mercor as the market leader in elite professional evaluation services. Multiple reinforcing advantages (proprietary talent data, APEX benchmark, quality premium) create a defensible moat.

Execution: Scaling from $1M to $500M ARR in 17 months represents the fastest revenue growth trajectory in SaaS history. This execution, achieved with minimal sales and marketing infrastructure, demonstrates extraordinary customer demand and product-market fit.

Timing: Meta's Scale AI acquisition created a market inflection point that Mercor captured rapidly. The shift from commodity data labeling to professional evaluation aligns with Mercor's core strengths. The exponential scaling of frontier AI labs' evaluation needs creates years of runway for continued hypergrowth.

Team: Three 22-year-old founders, backed by elite venture investors and angels (Thiel, Summers, Dorsey), demonstrate founder-level execution capabilities. The team's debate background, structured reasoning and rhetoric, maps directly onto the company's mission of teaching AI systems judgment and nuance.